Both a 403(b) and a Roth individual retirement account—IRA—can provide you with the tools necessary to prepare for retirement. However, there are a few important distinctions that set the two apart. Knowing how each plan works and the key differences between 403(b) vs Roth IRA plans can help you determine which plan is right for you. That being said, let’s dive in!

Discover the Benefits of a Cash Balance Plan! – Download Our Informative Infographic

What is a 403(b)?

A 403(b) is a retirement plan type offered only by public schools and qualifying nonprofits, churches, and hospitals. In some cases, employers can determine the list of funds that can be invested in their plan, meaning you can choose which investment options are available in your employees’ 403(b) plan. One of the benefits of 403(b) plans is that they may offer special provisions such as loans, which allow you to gain access to funds prior to a distributable event. In the event an employee leaves, 403(b)’s provide flexibility— the plan account can generally remain where it is unless the account is less than $5,000, but the employee may also choose to transfer the funds for consolidation purposes.

403(b) Contribution Guidelines

As a plan sponsor, one benefit you can offer in a 403(b) plan is the ability to match employee contributions. So, when they contribute to a plan, you can also contribute up to IRS limits.

The maximum contribution limit for a 403(b) plan increases with cost-of-living adjustments. At the time of this writing, the limit is $22,500. Employees over the age of 50 can make an additional catch-up contribution of up to $7,500 for a total of $30,000, if allowed for by the plan. Some employers also take advantage of a special “lifetime catch up” provision whereby employees who are in the last few years of retirement can deposit additional funds due to the fact they did not defer up to the maximum amount in prior years.

403(b) Tax Guidelines

Employer 403(b) plans are contributions are made with pre-tax dollars. Employee contributions can be pre-taxed, meaning all scheduled contributions will be deducted before taxes are calculated, or, in many plans, on a Roth basis. If a participant elects pre-tax, he or she must pay taxes on all withdrawals once you reach retirement. But what about penalties? Once you reach the age of 59 ½ years old, all distributions are penalty free, with your tax rate based on the tax bracket you fall in at the time of withdrawal.

Another tax advantage worth noting is all dividends, interest, and capital gains received in a 403(b) plan are tax deferred until they are withdrawn. If a participant has chosen Roth deferrals, they pay their taxes now and assuming the account meets Roth withdrawal requirements of being in a Roth vehicle for at least 5 years and the participant is age 59 ½., all withdrawals of principal and income are tax free.

What is a Roth IRA?

Unlike a 403(b), a Roth IRA is a separate personal account that is handled through a brokerage, bank or mutual fund and can be used by anyone. So, the participant is free to invest wherever they choose.

Roth IRA Contribution Guidelines

Also different from a 403(b), a Roth IRA does not allow for the matching benefit. This means that all the money saved in the accounts is only put there by employees themselves. The current contribution limit is $6,500. Account holders over the age of 50 may make catch-up contributions of up to $7,500.

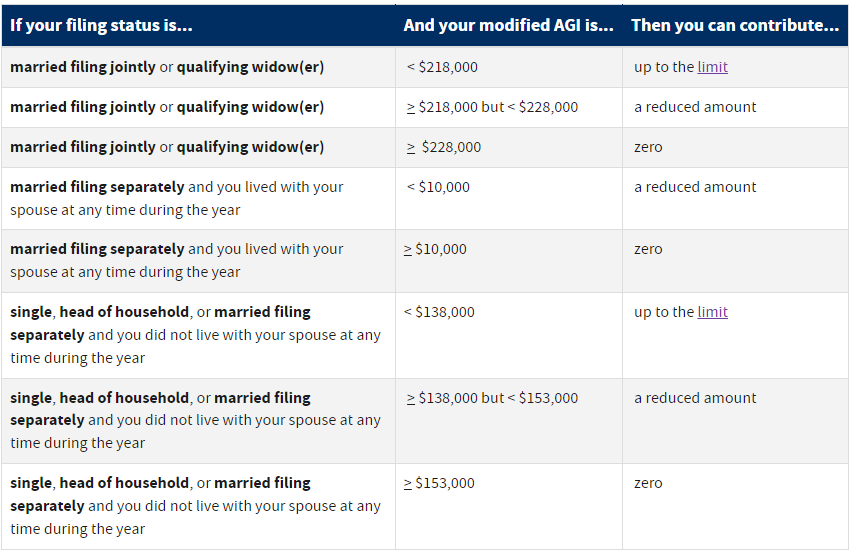

It’s also important to note that there is an income limit for making contributions to a Roth IRA that are dependent upon certain factors such as marital status and adjusted gross income—or AGI.

Table Courtesy of the IRS

Roth IRA Tax Guidelines

Roth IRA contributions are made with after-tax dollars and are always available for withdrawals, upon the 5-year anniversary of the Roth IRA account’s establishment and the account owner being 59 1/2, withdrawals are tax free.

403(b) vs Roth IRA: Which Plan Should You Choose?

As an employer, if you offer a 403(b), and if employees don’t exceed the income limit, they may make a Roth contribution as well. With this mixed account portfolio, you offer the benefits both plans offer by utilizing both current-year and deferred tax breaks. Above all else, it’s important to establish your organization’s retirement plan with a third-party administrator you can trust. California Pensions is an experienced TPA firm, so count on our team to help you create the retirement portfolio your business deserves.