At the end of 2021, the IRS announced the cost-of-living adjustments for 2022. These adjustments affect the 2022 retirement contribution limits. The Social Security Administration also announced that social security benefits would increase by 5.9% in 2022. This increase is the largest in almost 40 years. Here are a few of the retirement contribution limits that you should be aware of in 2022 and why the limits have changed.

Learn how to Save more for Retirement – Check out our Infographic

Why are the 2022 Retirement Contribution Limits Increased?

The 2022 retirement contribution limits have been increased because of the above-average inflation rate in the U.S. currently. The inflation rate in 2021 was 5.4%, which is higher than usual. The IRS takes this inflation rate into account when calculating the cost of living. A higher cost of living means that workers will need to save more to be able to maintain their lifestyle after retirement. This is why the IRS will increase the annual contribution limits some years.

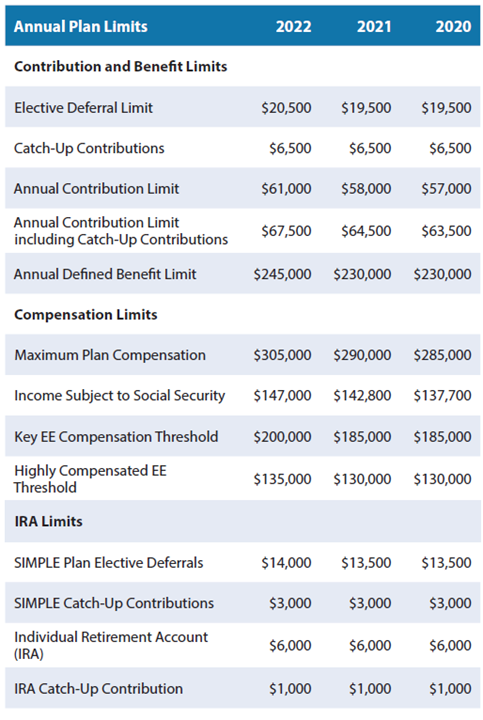

This chart shows the changes in plan limits for 2020, 2021, and 2022.

Important Contribution Limit Changes

- Elective deferral limits have increased from $19,500 to $20,500 per calendar year.

- $6,500 is still the limit for catch-up contributions.

- Catch-up contributions are only available to participants aged 50 or older.

- The contribution limit for a defined contribution plan has increased from $58,000 to $61,000.

- This limit includes both employee and employer contributions.

- For retirement plan compliance the maximum compensation that can be considered has been changed to $305,000 from $290,000.

If you have questions regarding how these changes may affect your retirement plan, please contact a member of the California Pensions team today! We are here to help you with all your retirement planning questions and concerns.