For plan sponsors and participants alike, managing retirement plans is essential. It seems every year brings with it rule changes and new regulations and 2025 will be no different. Therefore, being aware of the changes the new year will bring is an important part of managing your retirement plans. But how can you manage your plan on the right timeline? What are the deadlines and important dates to know? How can you be certain your 2025 plan goes beyond compliance, and becomes optimal? Let’s find out.

The Importance of Being Proactive

With the turn of each year comes the need for a fresh look at your retirement plan. Whether it’s adjusting to the new 401(k) contribution limits or keeping up with regulatory compliance, an annual check is essential.

Understanding 2025 Retirement Plan Updates

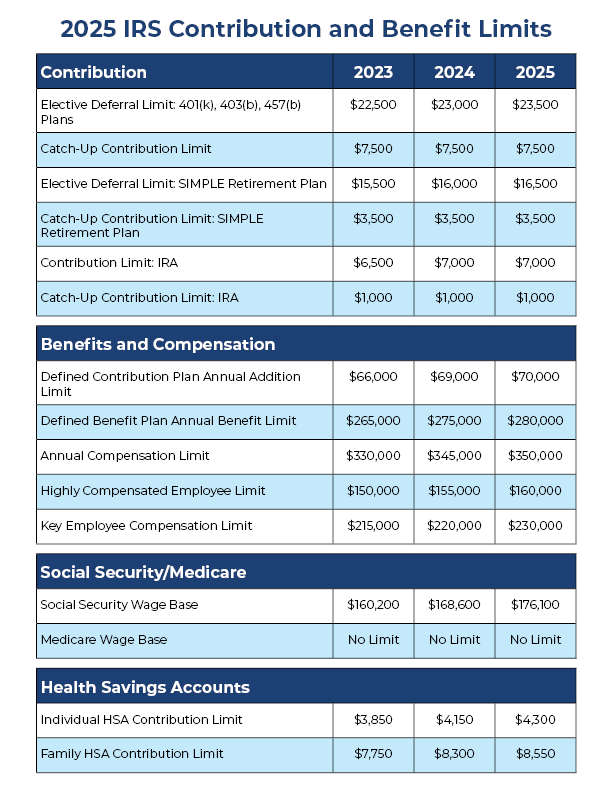

Before evaluating your planning checklist, let’s discuss the upcoming changes for 2025. The 401(k) contribution limits are set to increase to $23,500, up from $23,000 for 2024, so participants can save more for their retirement. Additionally, all catch-up contributions must be made as Roth contributions starting in 2025, which is a significant change you should be aware of. This, along with regulatory updates, presents unique opportunities and challenges for plan managers.

These regulatory updates include new requirements for annual disclosures, adjustments in the compliance procedures for plan loans and distributions, and updated guidelines for auto-enrollment and auto-escalation features in retirement plans.

How California Pensions Can Help

At California Pensions, we recognize the value of efficient retirement plan management. Our tools and services are designed to help you navigate new regulations and provide strategic support to maximize plan benefits for participants. From comprehensive compliance assistance to optimizing plan designs, we’re here every step of the way.

Your Annual Retirement Planning Checklist for 2025

Staying up-to-date with the yearly changes in retirement plans is key to making sure they work and meet all the regulations. But that isn’t enough. You need to apply your knowledge to make your retirement plan better. That’s why we have something useful for you – a checklist for your retirement planning in 2025. This list will help you know what to do all year long to make sure your retirement plan is the best it can be. Let’s take a closer look at what you should do throughout the year to keep your plan on track.

- Review new 2025 contribution limits and adjust payroll deductions as needed.

- Ensure compliance with the latest regulatory updates.

- Educate plan participants about any changes to the plan, including increased contribution opportunities.

- Schedule participant meetings to review plan benefits and retirement goals.

- Monitor plan performance and participant satisfaction.

- Consider plan design changes that could optimize benefits for participants.

- Prepare for year-end reporting and disclosures.

- Plan for any necessary adjustments in the upcoming year based on participant feedback and plan performance.

- Stay on top of regulatory updates and opportunities to improve plan offerings.

- Encourage ongoing participant engagement with their retirement savings.

Looking Ahead

The journey to a successful retirement plan requires both timely actions and informed decisions. When you start working early and planning ahead for 2025, you ensure your retirement plan continues to provide value and security for your participants.

Let California Pensions help you with your retirement planning. We can guide you through the new 2025 contribution limits, make sure you’re following the rules, and help you get the most out of your retirement plan. We’re here to assist you every step of the way.

Contact us today for a consultation, and let’s make 2025 a milestone year for your retirement plan. Together, we can achieve your retirement planning goals and secure a brighter future for all participants.