When it comes to retirement planning, plan sponsors have a choice to make. If they’re using a plan covered by the Employee Retirement Income Security Act (ERISA), they must ask themselves which is right for them: a defined benefit plan vs a defined contribution plan? Let’s investigate the features, advantages, and disadvantages of both types of plans to help you make an informed decision about which one is better suited for your specific needs.

Discover the Benefits of a Cash Balance Plan! – Download Our Informative Infographic

Defined Benefit Plan Vs Defined Contribution Plan

Defined Benefit Plans

Defined benefit plans are traditional pension plans which promise a specific benefit amount to employees upon retirement. Employers are responsible for funding these plans and determining the benefit payout based on factors such as years of service, average salary, and a predetermined formula. These plans offer the advantage of providing a guaranteed income stream for employees during their retirement years. However, they require employers to make ongoing contributions and assume the investment and longevity risks.

Defined Contribution Plans

In contrast, defined contribution plans are retirement plans in which both employers and employees can contribute funds. Examples of defined contribution plans include 401(k) plans, 403(b) plans and profit sharing plans. The contributions made to these plans are invested in various investment options. Upon retirement, the accumulated funds, including investment returns, are distributed to the employees. Employers have more flexibility with defined contribution plans as they have more control over contributions, but they don’t have the responsibility of guaranteeing specific benefit amounts.

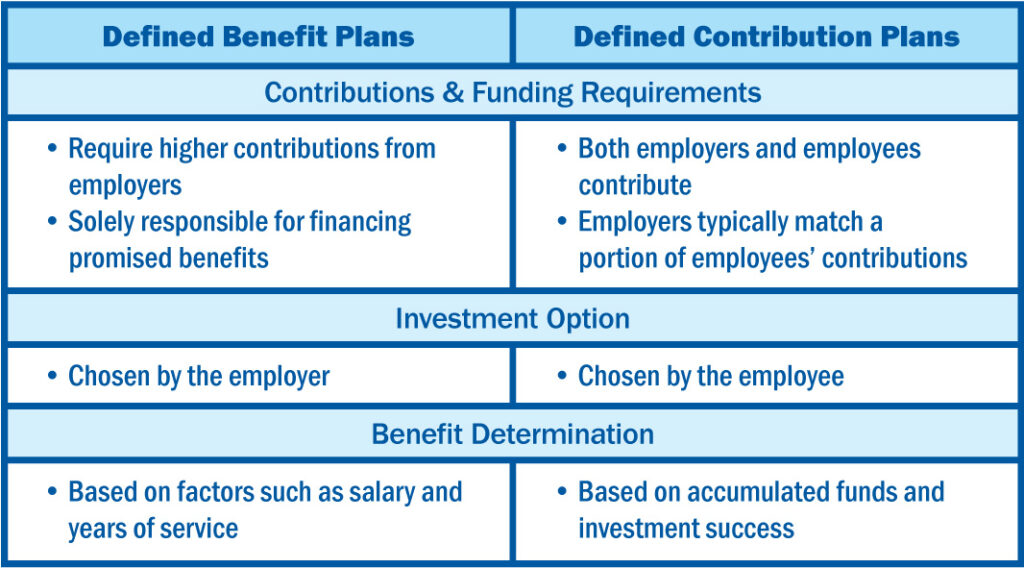

Key Differences Between Defined Benefit Plans vs Defined Contribution Plans

To help you more easily visualize what makes each plan unique, here’s a simple breakdown:

Understanding how defined benefit and defined contribution plans differ gives insight into which will be better suited for you.

Contributions and Funding Requirements:

Defined benefit plans usually require higher contributions from employers, as they are responsible for financing the promised benefits. In contrast, defined contribution plans involve contributions from both employers and employees, with employers typically matching a portion of the employees’ contributions.

Investment Options:

Defined benefit plans are managed by the employer, while defined contribution plans allow employees to make investment choices based on their risk tolerance and retirement goals.

Benefit Determination:

In defined benefit plans, the benefit amount is typically calculated based on factors such as salary and years of service. In defined contribution plans, the benefit amount is determined by the accumulated funds and the success of the investments.

Employer Contributions and Employee Participation:

Defined benefit plans are solely funded by employers, and the benefit amounts are not affected by employees’ contributions. In defined contribution plans, both employers and employees contribute, and the accumulated funds depend on the combined contributions.

When comparing defined benefit plans vs defined contribution plans, it’s important to note that the way contributions are handled differ.

Factors to Consider When Choosing Between Defined Benefit and Defined Contribution Plans

Once you have a clearer understanding of what differentiates a defined benefit plan from a defined contribution plan, you become one step closer to knowing which is right for your organization. Here are a few things you’ll want to take into consideration when choosing which option is the most suitable for you.

Company Size and Structure

Defined benefit plans are often more suitable for larger companies with a large, stable workforce, or owner-centric businesses such as a small law firm, while defined contribution plans are favorable for small and mid-sized businesses.

Long-Term Goals and Financial Stability

As a plan sponsor, be sure to consider your long-term financial goals and stability when choosing a retirement plan. Defined benefit plans provide a guaranteed income stream in retirement but require ongoing contributions. Defined contribution plans offer flexibility but depend on investment returns.

Employee Demographics and Preferences

Understand your employees’ expectations and preferences. Younger employees may prioritize greater control over their retirement funds and investment choices, while older employees may value the security of a defined benefit plan.

Defined Benefit Plan Vs Defined Contribution Plan: Whichever You Choose, California Pensions is Here to Help

Selecting the right retirement plan for your organization is a big decision, and a confusing one at that. If you need assistance navigating the complexities of your retirement plan choices and management, California Pensions is here to help. Well-versed in the plan design and management of both defined benefit and defined contribution plans, our experts will help you find the perfect solution for your organization. Contact us today for a free consultation and let our experienced team guide you towards the retirement plan that aligns best with your needs and circumstances.